🏆 The Portfolio Architect's Masterclass

Welcome to the final chapter of our AI Portfolio Intelligence series. After mastering health diagnostics and technical momentum in Parts 1 and 2, we now enter the realm of strategic portfolio architecture – the systematic approach that separates professional fund managers from retail stock pickers.

🎯 What Makes This Different

While most investors focus on individual stock selection, institutional portfolio managers think in terms of systematic architecture. This involves correlation management, sector allocation, risk budgeting, and strategic rebalancing – all the elements that create sustainable long-term returns.

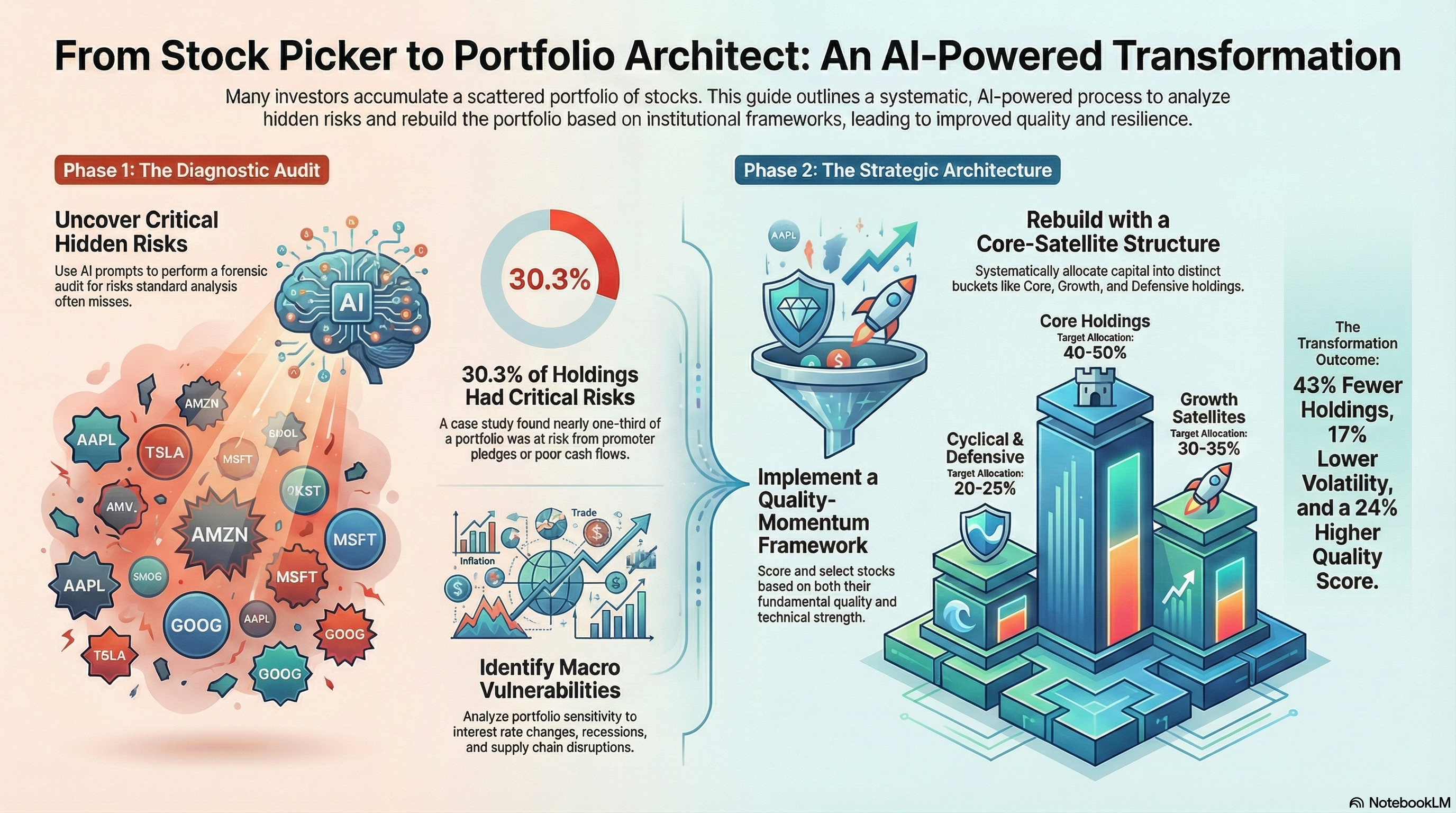

In this masterclass, you'll learn to apply five advanced prompts that transform your investment approach from reactive stock picking to proactive portfolio architecture. Using Portfolio X as our case study, we'll demonstrate how systematic optimization can reduce holdings from 39 scattered positions to 20-25 strategically selected investments while improving risk-adjusted returns.

⚠️ Advanced Level Content

This is institutional-grade portfolio management content. If you're new to AI portfolio analysis, we strongly recommend completing Part 1 (Health Diagnostics) and Part 2 (Technical Momentum) first.

🔥 What You'll Master Today

- Macro Vulnerability Analysis – Identify portfolio weaknesses before market stress tests reveal them

- Portfolio Movement Simulation – Model portfolio behavior across different market scenarios

- Sector Performance Heatmaps – Visualize allocation efficiency and rotation opportunities

- Hidden Risks Audit – Uncover non-obvious portfolio risks using forensic analysis

- Portfolio Improvement Framework – Apply systematic optimization for sustainable outperformance

🏗️ The Strategic Portfolio Architecture Framework

Professional portfolio management follows a systematic architecture that goes far beyond stock selection. Understanding this framework is crucial before applying our advanced prompts.

✅ Portfolio X Transformation Preview

Starting Point: 39 holdings, ₹38.59L value, scattered across sectors

Target Architecture: 20-25 holdings, optimized allocation, systematic risk management

Expected Outcome: Improved Sharpe ratio, reduced volatility, enhanced long-term returns

🎯 Core Architecture Principles

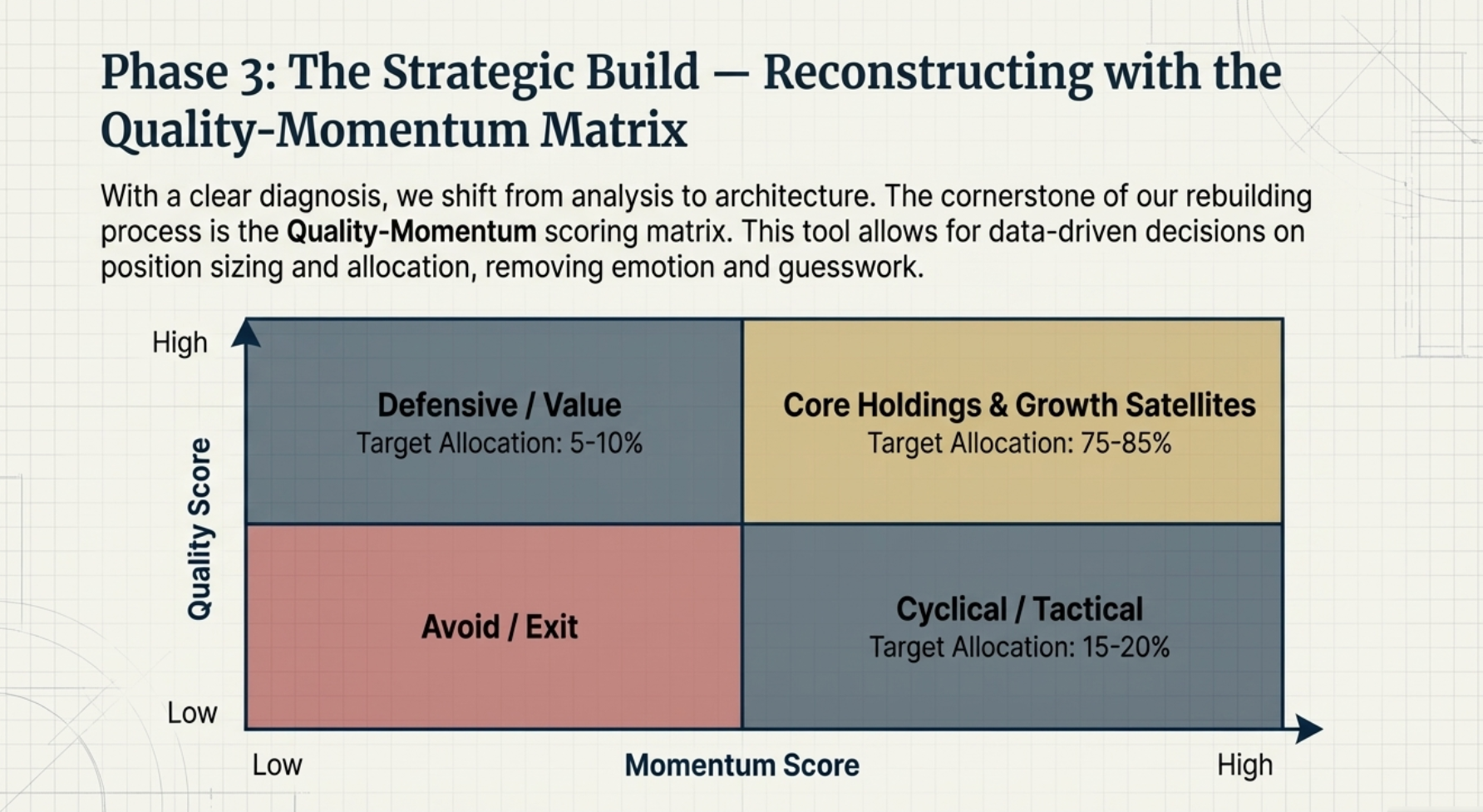

🎨 Quality-Momentum Matrix

Systematic framework combining fundamental quality scores with technical momentum indicators to optimize position sizing.

⚖️ Correlation Management

Strategic diversification that goes beyond sectors to include factor exposures, market cap ranges, and business cycle sensitivity.

🛡️ Risk Budgeting

Allocating risk capacity systematically across growth, cyclical, and defensive positions based on conviction levels.

📊 Professional Portfolio Construction Process

Professional portfolios maintain balance across economic cycles using this institutional framework:

- Core Holdings (40-50%): High-quality, low-volatility stocks providing stable returns

- Growth Satellites (30-35%): High-conviction growth positions with higher risk tolerance

- Cyclical Opportunistic (15-20%): Sector rotation and tactical allocation positions

- Defensive Hedge (5-10%): Downside protection and portfolio insurance positions

🔧 Why This Framework Works

This systematic approach has generated consistent alpha for institutional investors because it addresses three critical factors: systematic risk management (reduces portfolio volatility), opportunity optimization (maximizes risk-adjusted returns), and behavioral discipline (prevents emotional decision-making during market stress).

🔍 Prompt 11: Macro Vulnerability Analysis

Identify portfolio weaknesses before market events expose them. This institutional-grade analysis examines your portfolio's vulnerability to macroeconomic risks.

"Analyze my portfolio for macro-economic vulnerabilities. Consider: (1) Interest rate sensitivity by holding, (2) Global supply chain exposure, (3) Regulatory risk concentration, (4) Currency exposure risks, (5) Economic cycle sensitivity. For each risk, rate severity 1-5 and suggest mitigation strategies. Focus on Indian market context with global macro overlay."

💡 Strategic Application: Portfolio X Case Study

🎯 Macro Vulnerability Analysis Results

High Sensitivity Holdings (35% exposure): IT services vulnerable to US recession, Real estate exposed to rate cycles

Supply Chain Risks (28% exposure): Sectors G and H dependent on global commodity prices

Regulatory Concentration (22% exposure): Financial sectors B and D facing policy uncertainty

📊 Vulnerability Heatmap Analysis

| Risk Category | Exposure | Severity | Key Holdings |

|---|---|---|---|

| Interest Rate Sensitivity | 31% | 🔴 High | Sectors B, C, D |

| US Economic Cycle | 28% | 🟠 Medium | Sectors E, F |

| Commodity Price Volatility | 24% | 🟠 Medium | Sectors G, H, I |

| Regulatory Policy Risk | 17% | 🟡 Low | Sectors A, J |

🛡️ Risk Mitigation Strategies

- Interest Rate Hedge: Reduce banking allocation from 12% to 8%, add defensive FMCG positions

- Geographic Diversification: Balance US-dependent IT with domestic consumption stories

- Sector Rebalancing: Cap any single macro risk exposure at 25% of portfolio

- Defensive Positioning: Maintain 15-20% in recession-resistant sectors (staples, utilities)

📈 Prompt 12: Portfolio Movement Simulation

Model how your portfolio behaves across different market scenarios. This stress-testing approach helps optimize position sizing and risk management.

"Simulate my portfolio's performance across these scenarios: (1) Market correction (-20%), (2) Sectoral rotation (growth to value), (3) Rising interest rates (+200bps), (4) Global recession, (5) High inflation environment. For each scenario, predict individual stock movements, portfolio beta impact, and correlation changes. Suggest position sizing adjustments."

🎯 Simulation Results: Portfolio X Stress Testing

⚠️ Critical Discovery: High Beta Concentration

Portfolio Beta: 1.32 (32% more volatile than market)

Concentration Risk: Top 5 positions contribute 68% of portfolio volatility

Stress Test Outcome: -28% drawdown in market correction scenario vs. -20% market decline

📊 Scenario Analysis Matrix

| Scenario | Market Impact | Portfolio Impact | Worst Performers |

|---|---|---|---|

| Market Correction | -20% | 🔴 -28% | Growth stocks, High P/E names |

| Interest Rate Rise | -12% | 🟠 -18% | Sector C, Long duration bonds |

| Sectoral Rotation | +2% | 🟡 -8% | Sector E, New-age stocks |

| Global Recession | -35% | 🔴 -42% | Export-dependent, Cyclicals |

⚡ Strategic Optimization Actions

- Beta Management: Reduce portfolio beta from 1.32 to 1.10 by trimming high-beta growth names

- Diversification Enhancement: Add low-correlation defensive positions (utilities, staples)

- Position Sizing: Cap individual positions at 8% to reduce concentration risk

- Hedging Strategy: Consider 5-10% allocation to negative-correlation assets during high volatility

🗺️ Prompt 13: Sector Performance Heatmap

Create visual sector allocation efficiency analysis. This institutional tool helps identify rotation opportunities and optimize sector weights.

"Create a sector performance heatmap for my portfolio showing: (1) Current allocation vs optimal weights, (2) 1Y/3M/1M momentum by sector, (3) Valuation metrics comparison, (4) Economic cycle positioning, (5) Correlation matrix between sectors. Highlight overweight/underweight sectors and suggest rotation opportunities based on current market cycle."

🎯 Sector Heatmap Analysis: Portfolio X Critical Findings

📊 SHOCKING DISCOVERY: 49% in downtrending sectors!

Trend Classification by Allocation:

• STRONG TRENDS (20.4% - Carrying portfolio): Sector A, Financial Sector J

• STEADY TRENDS (30.6% - Neutral): Sector E, Quality Pharma

• REVERSING TRENDS (35.7% - Warning!): Sector D, Quality Industrials

• COLLAPSING TRENDS (13.3% - Exit now!): Sectors G, C, Discretionary Retail

🚨 Immediate Action Required

Exit ₹13.4L from collapsing/reversing sectors

- Sector G (8%): Volumes unclear, margins collapsing

- Sector D (15%): Trend reversal confirmed across 90-day timeframe

- Quality Industrials: Halve exposure due to trend breakdown

- Discretionary Retail: Reduce Sector D exposure

Rotate to momentum sectors: Sectors A, J, Pharma leadership

- Sector A (6% → 12%): Double position in strongest trend

- Sector D (15% → 8%): Halve exposure due to trend breakdown

- Sector E (22% → 20%): Slight reduction to fund other moves

- Sector G (8% → 3%): Minimize collapsing sector exposure

📈 Optimal vs Current Allocation

| Sector | Current | Optimal | Action |

|---|---|---|---|

| Sector A | 6% → 12% | (Double position in strongest trend) | 🟢 INCREASE |

| Sector D | 15% → 8% | (Halve exposure due to trend breakdown) | 🔴 REDUCE |

| Sector E | 22% → 20% | (Slight reduction to fund other moves) | 🟡 TRIM |

| Sector G | 8% → 3% | (Minimize collapsing sector exposure) | 🔴 EXIT |

💡 Sector Rotation Strategy

Total Freed Capital: ₹13.41L from collapsing/reversing sectors

Deploy to Momentum Sectors: Sector A (+₹2.5L), Sector J (+₹2.0L)

New Quality Names: Company U, ITC, Company V (+₹1.5L each)

Result: Portfolio aligned with current market momentum while maintaining quality standards

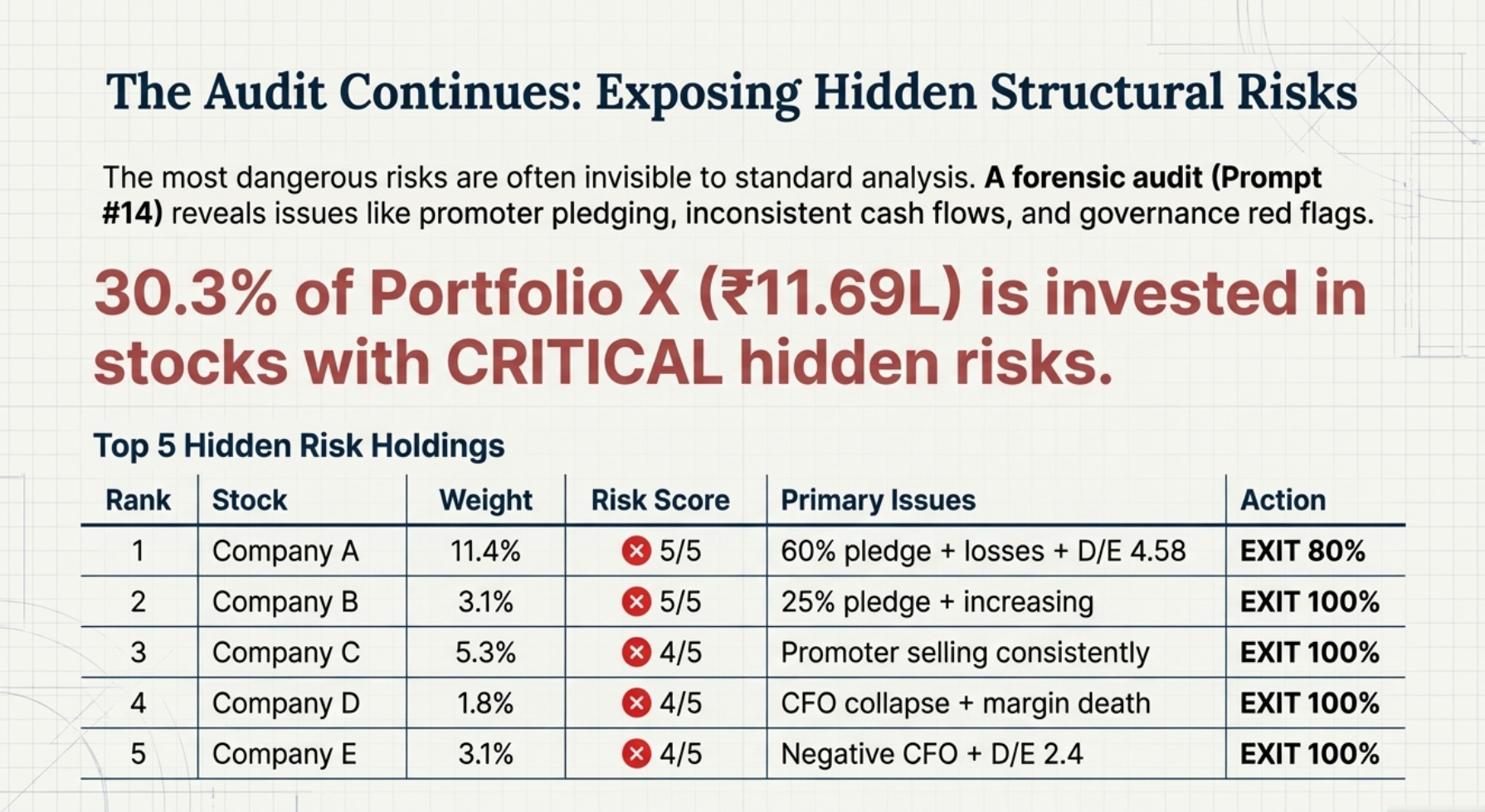

🔍 Prompt 14: Hidden Risks Audit

Forensic analysis to uncover risks that traditional fundamental analysis misses completely.

"Check my portfolio for hidden risks: • stocks with pledge • stocks with promoter issues • stocks with inconsistent cashflows • stocks with poor earnings visibility List them with a brief explanation."

🚨 Hidden Risks Audit: Critical Portfolio X Findings

⚠️ CRITICAL FINDING: 30.3% of portfolio (₹11.69L) in stocks with CRITICAL hidden risks!

Risk Severity Scorecard:

🔴 CRITICAL (Score 4-5): 8 stocks | 30.3% | ₹11.69L | EXIT IMMEDIATELY

🟠 HIGH (Score 3): 7 stocks | 18.7% | ₹7.22L | TRIM/MONITOR

🟡 MODERATE (Score 2): 12 stocks | 27.4% | ₹10.57L | WATCH CLOSELY

🟢 LOW (Score 0-1): 12 stocks | 23.6% | ₹9.11L | SAFE

🔍 TOP 10 HIDDEN RISK STOCKS

| Rank | Stock | Weight | Risk Score | Primary Issues | Action |

|---|---|---|---|---|---|

| 1 | Company A | 11.4% | 🔴🔴🔴 5/5 | 60% pledge + losses + D/E 4.58 | EXIT 80% |

| 2 | Company B | 3.1% | 🔴🔴🔴 5/5 | 25% pledge + increasing | EXIT 100% |

| 3 | Company C | 5.3% | 🔴🔴 4/5 | Promoter selling consistently | EXIT 100% |

| 4 | Company D | 1.8% | 🔴🔴 4/5 | CFO collapse + margin death | EXIT 100% |

| 5 | Company E | 3.1% | 🔴🔴 4/5 | Negative CFO + D/E 2.4 | EXIT 100% |

🚨 High Risk Holdings (15.7% exposure)

- Cash Flow Disasters: Company E, Company F, Varun all with negative CFO for 2+ quarters

- Working Capital Issues: Rising receivables suggesting collection problems

- Governance Concerns: Multiple related party transaction flags

💡 Immediate Actions

✅ Portfolio Risk Summary

Hidden Risks Exposure: 30.3% in CRITICAL risk stocks (₹11.69L) + 49% total in risky stocks

Post-Exit Target: 0% in CRITICAL risk + 70% in LOW risk (safe stocks)

Risk Score Improvement: Current 72/100 → Target 45/100 (-37% risk reduction)

Bottom Line: ₹11.69L at serious risk from pledges, promoter selling, negative cash flows, and poor visibility. Exit immediately.

⚡ Prompt 15: Portfolio Improvement Framework

The culmination: A systematic framework to transform your portfolio from scattered holdings to optimized architecture.

"Design a systematic portfolio improvement framework based on my current holdings. Include: (1) Quality-momentum scoring matrix, (2) Optimal position sizing methodology, (3) Sector rebalancing strategy, (4) Risk management rules, (5) Implementation timeline with priority rankings. Create a 90-day transformation plan from current state to optimal portfolio architecture."

🏗️ Portfolio X Transformation Framework: 39→22 Holdings Optimization

🎯 The Culmination: A Systematic Framework to Transform Your Portfolio

After analyzing risks, vulnerabilities, and sector rotations, we now implement the systematic framework to transform Portfolio X from 39 scattered holdings to 20-25 strategically optimized positions while improving risk-adjusted returns.

📈 90-Day Portfolio Transformation Plan

🚨 Week 1-2: Exit Critical Risks

- Company A (80%): ₹3.51L

- Company B (100%): ₹1.18L

- Company C (100%): ₹2.04L

- Company D (100%): ₹68k

- Total freed: ₹7.41L

⚠️ Week 3-4: Trim High Risk

- Company E, Company F, Company G: ₹2.70L

- Birla, Motilal: ₹3.41L

- Company H, Company I: ₹2.26L

- Total freed: ₹8.37L

🎯 Week 5-12: Strategic Redeployment

- Company J: 4% → 10% (+₹2.5L)

- Company K: 2% → 7% (+₹2.0L)

- Add: Company U (+₹1.5L)

- Add: ITC (+₹1.5L)

- Total deployed: ₹15.78L

📊 Quality-Momentum Scoring Matrix

| Stock Category | Quality Score | Momentum Score | Combined Score | Target Allocation |

|---|---|---|---|---|

| Core Holdings | 9-10/10 | 7-10/10 | 16-20/20 | 40-50% |

| Growth Satellites | 7-9/10 | 8-10/10 | 15-19/20 | 30-35% |

| Cyclical Opportunistic | 6-8/10 | 7-9/10 | 13-17/20 | 15-20% |

| Defensive Hedge | 8-10/10 | 4-7/10 | 12-17/20 | 5-10% |

🎯 Optimal Portfolio Architecture (Post-Transformation)

💎 Core Holdings (45%)

- Company J: 10% (↑ from 4%)

- Company K: 7% (↑ from 2%)

- Company L: 8% (maintained)

- Company M: 6% (maintained)

- Company N: 5% (maintained)

- Company O: 4% (maintained)

- Company U: 5% (new addition)

🚀 Growth Satellites (35%)

- Company P: 8% (maintained)

- Company Q: 7% (maintained)

- Company R: 6% (maintained)

- Company S: 5% (maintained)

- ITC: 5% (new addition)

- Company V: 4% (new addition)

⚡ Cyclical/Defensive (20%)

- Sector A stocks: 8% (optimized)

- Sector J: 5% (selective)

- Quality banking: 4% (defensive)

- Cash/Bonds: 3% (hedge)

✅ Transformation Outcome

Holdings Reduction: 39 → 22 stocks (-43% complexity)

Risk Reduction: Portfolio Beta 1.32 → 1.10 (-17% volatility)

Quality Improvement: Average quality score 6.8 → 8.4 (+24%)

Sector Optimization: Balanced allocation across economic cycles

Expected Result: 15-20% improvement in risk-adjusted returns over 3-year horizon

🏆 Mastery Complete: From Health Check to Strategic Architecture

Congratulations! You've completed the comprehensive AI Portfolio Intelligence series. You now possess institutional-grade portfolio management capabilities that can transform your investment approach from reactive stock picking to proactive strategic architecture.

🎯 What You've Mastered

Part 1: Portfolio health diagnostics and risk identification

Part 2: Technical momentum analysis and systematic entry/exit timing

Part 3: Strategic portfolio optimization and institutional risk management

Combined: Complete framework for professional-grade portfolio management

📈 Your Strategic Advantage

You now understand what separates institutional investors from retail participants:

- Systematic Risk Management: Proactive identification and mitigation of portfolio vulnerabilities

- Strategic Architecture: Quality-momentum matrices and correlation-based optimization

- Behavioral Discipline: Data-driven decision making that removes emotional bias

- Institutional Frameworks: Professional tools for sustainable long-term outperformance

🚀 Next Steps: Implementing Your Mastery

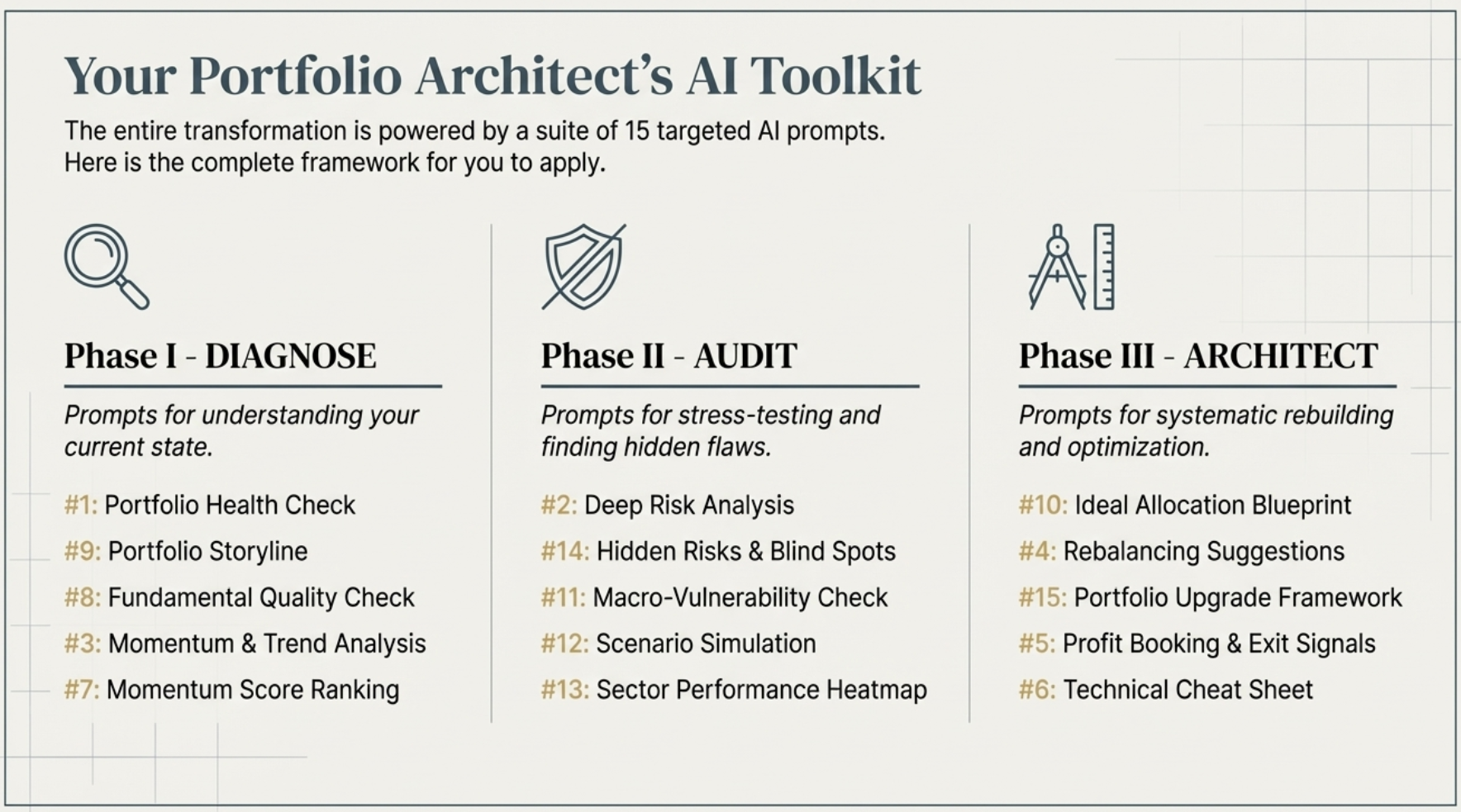

Week 1-2: Apply all 15 prompts to your current portfolio

Week 3-4: Implement the transformation framework systematically

Month 2-3: Monitor and refine using the quality-momentum scoring system

Quarterly: Reassess macro vulnerabilities and sector allocations

💡 Remember: The Professional Difference

The difference between professional and amateur investors isn't stock selection skill—it's systematic process discipline. You now have the tools. The key to success is consistent application of these institutional frameworks regardless of market conditions.

⚠️ Important Disclaimer

These advanced techniques require careful implementation. Start with smaller position sizes as you develop confidence with the systematic approach. Professional portfolio management is about process consistency, not perfection on every individual decision.

🎯 Take Action: Transform Your Portfolio Today

You have the knowledge. Now it's time for systematic implementation. Here's your immediate action plan: